Valuations & Property Risk Information

Gain deep insights into property valuations and inherent risks — without stepping on-site. Our platform uses spatial intelligence, historical productivity, infrastructure mapping, and environmental hazard layers to deliver high-confidence, desktop-based property profiles for insurers, lenders, and agribusinesses.

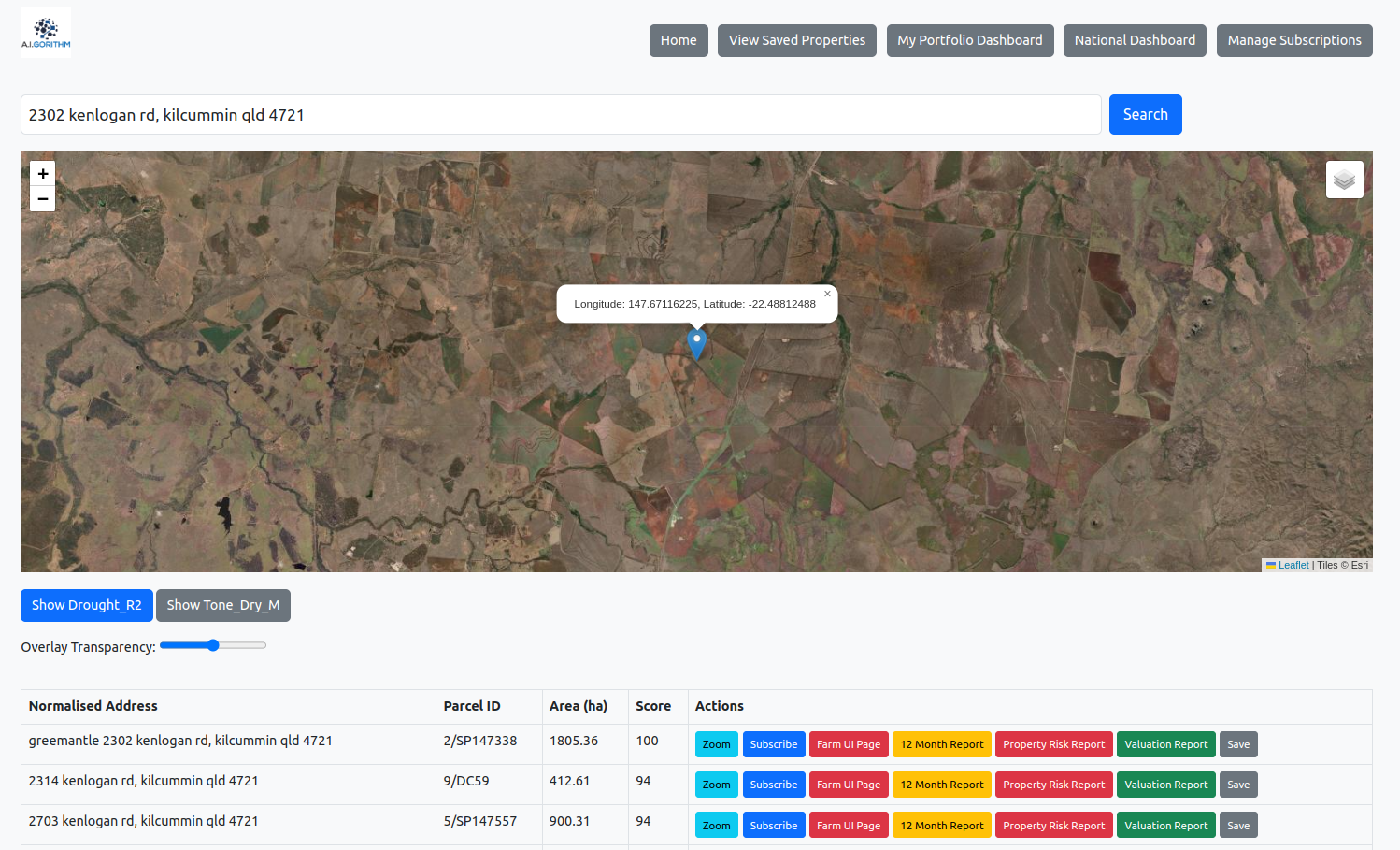

🔎 Seamless Search & Parcel Insights

Find any rural property in seconds. Simply enter an address, and our platform auto-detects matching land parcels, overlays risk layers, and provides instant access to valuation, production, and climate exposure reports.

- Instant parcel lookup via address or coordinates

- Overlay drought, fire, or vegetation metrics with one click

- Compare scores and hectares across multiple parcels

- Generate and export property reports in seconds

📍 Desktop Valuation Model

We calculate estimated valuations based on building footprint, land use, pasture/cropping productivity, and localized market indices. This allows underwriters and assessors to understand the value of improvements and potential production remotely.

- Building size × cost/m² estimation

- Inferred livestock headcount from land use & size

- Annual cropping revenue potential

- Replacement value estimate for infrastructure

- Comparable productivity-based valuation proxy

🔥 Risk-Weighted Insights

We overlay natural hazard layers and benchmark risk scores by percentile, enabling portfolio-level stress testing and claims scenario analysis.

- Fire, flood, and frost exposure scores

- Past event footprint overlays

- Benchmark farm to region in terms of yeild and variances in years

- Historical resilience and NDVI recovery rates

- Sum insured vs risk-adjusted value gap

🔄 Change Detection & Monitoring

Track land use and productivity change over time — such as vegetation clearing, infrastructure development, irrigation expansion, and biomass shifts.

- 5- and 10-year change in vegitation growth rates, or building area change

- Detection of new sheds, pivots, or re-vegetation

- Land use classification shifts by paddock

- Grazing/cropping potential and stocking estimate changes

📊 Delivery Formats & Use Cases

Our valuations and risk data help insurers assess replacement costs, underinsurance, and payout limits. For banks, it supports credit risk review, climate exposure scoring, and regional market insights.

- Interactive dashboard with map, charts, and trends

- API integration for underwriting & lending platforms

- Custom-branded PDF reports for portfolios or single properties

- Bulk portfolio uploads & valuation summary exports